Table of Contents

- Portfolio Theory is Lost in the 1970s

- Dynamic Asset Allocation

- Active Management Using Asset Allocation is More Practical than Security Selection

- Why the Active Versus Passive Debate is Misguided

- A Call to Action

- An Uncertain Future

- Conclusion

Introduction

“Progress is impossible without change, and those who cannot change their minds cannot change anything.”George Bernard Shaw

Determining the right approach to asset allocation is the most important decision an investor or financial advisor needs to make. Perhaps the biggest challenge is that there are so many different investment strategies to choose from that the decision can be overwhelming. Faced with changing investor goals and also constant fluctuations in the financial markets requires that the investment strategy chosen must also change over time. Investor behavior also presents a set of unique challenges; a strategy is only as good as the ability of a person to stick with it in practice. Markets often make dramatic shifts as the global economy morphs in unpredictable directions that humble the best market experts. One thing however is certain; in an uncertain world, the only constant is change itself. Managing risk in the face of this uncertainty requires the ability to adjust and respond to changing conditions. Human beings often let their emotions get the best of them when making investment decisions. We believe Dynamic Asset Allocation is the best approach for investors trying to manage portfolios in the real world.

Portfolio Theory is Lost in the 1970s

“I have found out that perhaps the experts on investing and financial economics are not as skilled as the public has been lead to believe. I think that a strong case can be made that the main application of the last 50 years of research in portfolio theory has been in marketing all sorts of investment vehicles.”John Nuttall, former professor at the University of Western Ontario and author of “The Importance of Asset Allocation”

Traditional portfolio management as it is currently practiced is a first generation strategy. It was built upon a set of assumptions that were too simplistic for the real world. The foundation of the traditional approach is built upon three primary models:

- Modern Portfolio Theory (MPT) which was introduced by Harry Markowitz in 1952

- The Capital Asset Pricing Model (CAPM) introduced by William Sharpe in 1970, and

- The Efficient Markets Hypothesis (EMH) introduced by Eugene Fama in 1965.

These three models form the foundation for standard curriculum for both finance education at business schools and industry designations such as the Chartered Financial Analyst (CFA) program. It is no surprise therefore that these concepts have driven the principles and standards for portfolio management across the industry. In general, they promote a strategic, or passive approach, to investing driven by long-term assumptions for returns across asset classes. In other words, they are ‘one-period’ models that encourage investors to ‘set it and forget it.’ Conveniently, they also lend themselves to easy maintenance for financial advisors. Their typical advice to clients is to ‘stay the course’ while paying fees through one market crisis after another. Apparently, complacency can be justified by academic studies that are nearly 50 years old.

Despite the widespread popularity of these models, it is important to understand that they are relics from a very different era. At that time computing power was scarce, modern econometric methods were not available, and financial theory was in its infancy. For example, in the 1960s, trying to calculate portfolios using MPT would have required a computer that would occupy a floor of an entire building. But even if you could obtain the results, they assumed perfect foresight with no margin for uncertainty. Using more formal mathematics, Robert Merton, a Nobel Prize winner and father of option pricing models, was the first to demonstrate the obvious flaws in the MPT/CAPM approach to portfolio management. In his paper he wrote in reference to MPT/CAPM: “The proponents of the model who agree with the theoretical objections, but who argue that the capital market operates as if these assumptions were satisfied, are themselves not beyond criticism.”

This quote was broadly reflective of the state of academia at the time: a near religious cult where the founding principles could not be challenged without consequences to your publishing career. Merton’s ‘Inter-Temporal CAPM’ (ICAPM) presented a framework that championed dynamic asset allocation, a multi-period model where a portfolio needed to change dynamically as a function of market movements and current wealth. More importantly, the ICAPM also accounted for the fact that markets and wealth are uncertain. This framework became the foundation for future research on dynamic asset allocation. Merton’s vision of a dynamic asset allocation approach borrowed a lot from modern option theory – a price for a derivative had to capture a range of possible outcomes.

The ICAPM was not adopted by practitioners because it was too sophisticated to follow and required even greater computing power than MPT. But a key conclusion was lost from Merton and Samuelson’s work on the “portfolio problem”: a “one-period” approach like MPT or strategic allocation was mathematically insufficient for wealth management. In the industry it is well-accepted that factors such as “required income” and “time to retirement” should be considered in determining portfolio allocations. Using a one-period approach where the portfolio does not change asset allocation is perhaps only reasonable for endowments with near infinite time horizons. Thus it is hard to reconcile why the industry continues to accept a strategic allocation approach. However, like many religions, convention and tradition are hard to break.

But the inconsistencies are even greater as you dig deeper into the body of research. One of the cornerstone assumptions for the EMH and the CAPM was that the market followed a random walk. This concept was first introduced by Louis Bachelier in 1900 and implies that past price movements cannot be used to predict future price movements. Tests of this theory were performed in the 1960’s (see Fama 1965) before reliable econometric methods for analyzing time series data had been introduced. In 1999, two distinguished professors Andrew Lo (MIT) and Craig MacKinlay (Wharton) published a book called “A Non-Random Walk Down Wall St.” The title was a meant to discredit passive investing champion Burton Malkiel’s very influential book “A Random Walk Down Wall Street,” which set a course for traditional portfolio management for years to come. Using advanced econometrics, Lo and MacKinlay demonstrated that a random walk does not exist nor has it ever existed in organized markets. Much of the post 1990’s academic research strongly supports this contention. In fact, “time series momentum” recently reviewed by Moskowitz (2012) shows that past returns forecast future returns for every single one of the 58 liquid markets covered in his study. However, conclusions that the market follows a random walk were not revised despite the weight of modern evidence.

Another cornerstone assumption underlying early financial theory was that investors were rational and shared the same mindset (or utility curve) towards risk. In contrast, the field of “Behavioral Finance” has convincingly demonstrated that investors are human and hence far from being perfectly rational. Their findings were built upon the foundation of a large body of research by psychologists showing obvious flaws in our ability to process information objectively. Pioneers in behavioural finance have demonstrated that investors have a wide variety of cognitive biases such as overconfidence, over-reaction, representative bias and information bias. Furthermore, the traditional EMH assumption that investors have the same objectives and risk profile is obviously flawed. Some investors prefer to make absolute returns which spawned the growth in hedge funds. In contrast other investors are more concerned with relative returns to some benchmark like the S&P500 index.

While a lot of new research has emerged along with better models, portfolio management remains firmly stuck in the 1970s. It is almost as if there is a flat Earth club that has chosen to ignore recent scientific findings showing that the Earth is actually round. A modern survey of the research reveals a more balanced prescription for managing investor portfolios than traditional theory. After conducting an extensive review of the research, James Picerno (Dynamic Asset Allocation, 2010) states, “The central message in the updated MPT is that asset allocation should be dynamic, or at least partially so. That’s in contrast to the conventional reading of MPT, which suggests that returns are unpredictable and therefore asset allocation should be static.”

“One suggestion as to tentative [mean and volatility] is to use the observed [mean and volatility] for some period of the past. I believe that better methods, which take into account more information, can be found.”Harry Markowitz

Dynamic Asset Allocation

From a holistic financial planning perspective, dynamic asset allocation can be defined as adjusting investor portfolios to consider all aspects of their unique situation such as:

- their current and expected future wealth;

- level of current and future income;

- financial needs in the form of current and future planned expenses; as well as

- their overall financial goals.

Risk tolerance and the capacity to make financial decisions can also change over time. Taxes or regulations can also necessitate a change in the portfolio approach. In real life, investors (or their advisors) change their asset allocation as time goes on, and as new information becomes available. In general, financial planners would agree that changing asset allocation (or being dynamic) to address changing market conditions and client circumstances is the only practical method in the real world.

The financial markets also change over time, and holding all financial planning factors constant, this becomes another important input for adjusting portfolios. One of the important drivers of changes to asset allocation should be changes in our expectations for returns or risk (Markowitz, 1952). In his paper titled “Portfolio Selection,” Markowitz discussed how to arrive at expected returns and volatility (E-V). What is interesting is that despite the fact that MPT is commonly thought of as a passive approach using a long-term historical set of inputs, Markowitz actually favored a dynamic approach that adjusts expectations over time as markets change:

“To use the E-V rule in the selection of securities we must have procedures for finding reasonable [estimates of expected return and volatility]. These procedures, I believe, should combine statistical techniques and the judgment of practical men. My feeling is that the statistical computations should be used to arrive at a tentative set of [mean and volatility]. Judgment should then be used in increasing or decreasing some of these [mean and volatility inputs] on the basis of factors or nuances not taken into account by the formal computations…

Mathematically, changes in expectations must change the optimal portfolio allocation. This can have a dramatic impact on the right balance between stocks and bonds regardless of risk tolerance. Using MPT math, the chart below shows the required portfolio allocation between stocks and bonds as a function of changes in the expected return for stocks:

to Change in Equity Expected Returns

But should our expectations for risk and return change over time? Perhaps one of the most debated questions in financial research is whether asset returns or risk premia are predictable. This question is significant because it guides portfolio choice. If asset returns are independently and identically distributed over time, then the optimal asset allocation is constant over time (Merton (1969) and Samuelson (1969). In other words, investors are better off with a strategic allocation approach. However, if asset returns are somewhat predictable, then the optimal asset allocation depends on the investor’s time horizon and the degree of predictability. (Brennan et al. 1997), Campbell and Viceira (1999) and Kim and Omberg (1996). Given that there is substantial evidence that asset returns are reasonably predictable (Jung and Shiller 2005), and that investors have changing wealth and financial objectives, a dynamic asset allocation approach must be optimal.

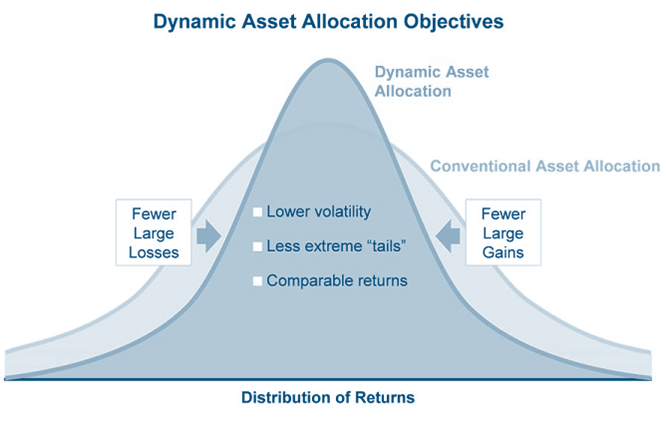

It is important to define what we mean when we refer to our “dynamic” asset allocation approach. The definition of “dynamic” is a system or process characterized by constant change or progress. A dynamic asset allocation approach changes positions across a global opportunity set of asset classes from equities, fixed income, credit and real assets. This approach primarily tries to capture macro-inefficiencies, which is where most of the “active” opportunities are the greatest. As economic regimes shift, certain assets outperform while others underperform. By using a time-tested principle called ‘momentum,’ we are able to shift and adjust the portfolio to be in sync with global markets. Favorable asset classes are held in the portfolio while unfavorable or risky asset classes are avoided. This changes the distribution of returns versus traditional strategic allocation to improve consistency, reduce volatility, and mitigates the number of unfavorable shocks or tail risks to the portfolio:

Conventional asset allocation is built on the assumption of averages and normal distributions. However, the financial markets are less well-behaved than the physical world. It seems as if every 5-10 years portfolio managers complain about an event that should have occurred only once in a billion years (source: “The Quants”). But there is another problem with averages – even in the physical world:

The challenge with averages is they can be highly unreliable. From a survival perspective we need to have a method for identifying when our environment is different from our expectations. A mountain climber may see that the average temperature is 50 degrees and sunny in a given location at a particular time of year. But the expert will pack a range of clothing items to protect them from extreme changes in temperature, and adjust their daily gear as they observe the current conditions. Failure to adapt could result in catastrophe. The expert climber employs a method similar to dynamic asset allocation which adjusts over time to changing conditions. The novice climber is like the typical investor; they plan for average conditions, and if they climb the same mountain a hundred times they are likely to survive (on average). Similarly, they expect to make 8% “on average” on their investments and use this to plan for retirement. Unfortunately, financial planning shares many of the same realities of mountain climbing; an investor may only get one shot and the cost of things going wrong can be devastating.

Active Management Using Asset Allocation is More Practical than Security Selection

“About three-quarters of a typical fund’s variation in time-series returns comes from general market movement, with the remaining portion split roughly evenly between the specific asset allocation and active management.”Roger IbbotsonDynamic asset allocation is a simpler way to engage in active portfolio management than traditional approaches. The broad stock market and other asset classes such as fixed income and commodities are closely linked to the factors that govern the world economy. By managing asset allocation you can adjust to these factors more directly and precisely with very few underlying holdings. Furthermore, making active macro decisions is a more lucrative and less competitive area than engaging in traditional active management.

As we discussed, the majority of so-called “active managers” worldwide are focused on making decisions within an asset class (such as equities) or a particular style of investing (such as small-cap value). In finance terms, this is considered to be security selection rather than asset allocation. It is clear that the markets are highly micro-efficient; a large number of studies have shown that active managers fail to outperform their passive benchmarks. To return to our driving analogy, traditional active managers are like the drivers that like to constantly switch lanes in traffic with the hopes of reducing their commute time. They focus all their energy on trying to be in the right lane, but ignore the more important decisions such as avoiding high traffic routes altogether. As most of us know, switching lanes frequently in traffic does not save you time on average it just increases frustration and the probability that you will get into an accident. Given this analogy, we believe that it is difficult to engage in successful security selection using a discretionary approach at the micro level where the market is highly competitive and significant opportunities are more scarce.

Traditional active management is also hampered by a high cost structure and the practice of ‘closet-indexing,’ where managers are so afraid of underperforming their benchmarks that they hold a portfolio nearly identical to the index (which guarantees underperformance). The analogy would be offering to pay a cab driver more money to find a faster route to get you to your destination, but instead of taking a shortcut and driving more aggressively, they choose to play it safe and use the same route as the typical cab driver. In this case your extra money is being wasted and you would be better off choosing the cab that offers the lowest fare. Sadly research finds that this is the case for most equity fund managers. Petajisto (CFA Institute, 2013) sorts all fund managers on the basis or active share, or the degree of active management. He finds that closet indexers significantly underperform while the most active managers actually outperform passive benchmarks after fees. This certainly offers a window of hope for active management within asset classes, however, achieving these results would require diversifying across dozens of managers that have a high active share which is impractical unless you are a pension fund.

There is yet another challenge with focusing only on security selection. Unless you are the next Warren Buffett, the potential for significant and consistent outperformance is highly limited. This is because managers are forced to stay within a certain box such as large-cap value or small-cap growth. A really good manager might outperform within these boxes by a margin of say 2-3% annualized, but this takes away the greatest source of opportunity which is being able to dynamically switch styles where you transition from value to growth or large to small as they shift in and out of favor. For example, Wang (2003) finds that between 1960 and 2001 the difference between the winning and losing investment styles was an incredible 16% annualized which could be captured using a simple momentum strategy. If there is this much opportunity within asset classes by taking a more macro approach, then certainly there is even more opportunity by looking across asset classes.

Most investors and advisors are unaware that the allocation between asset classes accounts for the majority of the return and risk of a portfolio. We define asset allocation as the choice to overweight or underweight exposure to a broad set of asset classes such as bonds, stocks, commodities, real estate, credit and global markets. Security or stock selection is a lower-level decision with much smaller influence on portfolio performance. A study by 2000 Roger G. Ibbotson and Paul D. Kaplan “Does Asset Allocation Policy Explain 40, 90 or 100 Percent of Performance?” helps to confirm this assertion. The authors looked at returns for 94 balanced mutual funds and 10 years of data for 58 pension funds and found that asset allocation explains about 90% of the period-to-period variability of a portfolio. The authors also found, however, that the most important factor was the stock market itself. Hence, managing exposure to the stock market is more important than what stocks you pick.

Staub and Singer (2011) conducted a comprehensive study showing the different components of portfolio performance. Unlike previous studies which held asset allocation mix constant, Staub and Singer use a set of reasonable assumptions to prove mathematically the relative importance of security selection versus active management using asset allocation. They used something fancy called ‘principal components’ which is a traditional method in scientific analysis to determine the independent sources that explain the data. The chart below shows the breakdown:

Performance Attribution (Explained Correlation)Source: Staub and Singer, 2011The ‘market selection’ is similar to switching equity styles, or favoring say US Equities over Foreign Equities. The ‘asset/cash’ decision is the macro decision to de-risk the entire portfolio and hold a greater fraction in cash. The ‘asset class decision’ is the choice of asset class such as stocks or commodities to invest in. Finally, ‘security selection’ is simply stock selection or the selection of any individual instrument within an asset class category. In aggregate, 65% of your performance is dictated by broader asset allocation decisions. This means that most of the value that can be potentially added to your portfolio is coming from sources that most traditional active managers (which use security selection) typically ignore. Furthermore, the 35% that they tend to focus on is the most difficult source of value since it is the most efficient and competitive category.

As we have stated, most advisors and large institutions tend to fix the percentage allocation to each asset class such as the proportion in stocks versus bonds. This becomes their policy asset mix that is held constant over time. Where they differ is that most institutions now favor using passively managed ETF’s or mutual funds to gain asset class exposure while advisors and retail investors favor actively managed mutual funds. We also favor using passive low-cost ETF’s within a dynamic asset allocation approach that targets the 65% of value-added that is left on the table using a more traditional approach.

The breakdown makes sense under closer inspection – the chances are very good that no matter what stocks you selected in 2008, you would have had a losing year since nearly all stocks went down. However, certain asset classes such as treasuries and gold managed to perform very well. During the year 2000 when the technology market crashed and large-cap stocks were doing poorly, value stocks were doing very well – especially in the small-cap space. During the 1970’s when both stocks and bonds did poorly, commodities did exceptionally well. There is always a bull market somewhere, and if there isn’t you always have the opportunity to hold cash. Some of the most successful investors of all time have focused on a Global Macro approach to investing which can be either discretionary (like George Soros) or systematic (like John Henry). We believe that the best approach is to use passive vehicles like ETF’s instead of using security selection, and focusing on active decisions across different markets and asset classes while managing overall portfolio risk.

Why the Active Versus Passive Debate is Misguided

The world of investment management is sharply divided into two camps – active and passive investing. Active investors believe that making educated decisions with better information and/or analysis will lead to above average results. Passive investors believe that simply buying and holding a diversified basket of securities will lead to superior performance over active managers. The classification of investment styles into either active or passive has led to substantial confusion across the board where both sides believe the other method is destined to fail, however, the reality is much more complex.

The problem with having two distinct camps of investing implies that the division between the two is concrete and well-defined. Like most things in life, the truth lies somewhere closer to the middle. Frequently there are aggressive marketing campaigns supported by either famous professors or portfolio managers that tend to polarize their positions. Research done by psychologists demonstrates that this is typical behavior, and is one of the reasons why international conflicts endure. Once you choose a side, you tend to close your mind towards accepting conflicting information. Your opinions and emotions towards the other group become negative and adversarial. Furthermore, cognitive dissonance causes you to invent reasons to justify your position. Even esteemed professors like Eugene Fama (father of the EMH) are not immune from this problem. Our approach to investment management is to have an open mind and draw the best concepts from both sides of the debate.

Ironically, the “founding fathers” of passive investing actually support active investment management. Their application of active management is instead framed using a different terminology within their own money management firms. Examples are Dimensional Fund Advisors (DFA) where they employ a ‘factor approach’ to investing that capitalizes on anomalies included in the Fama-French studies (value, momentum, market capitalization etc.). A traditional DFA approach is actually a hybrid between active and passive investing – active tilts are added via factor bets to a portfolio that is otherwise fairly passive. The Fama-French models are exercises in empirical data mining and are not supported by financial economic theory. In other words, they have examined numerous factors that affect stock returns and simply cherry-picked the ones that worked in hindsight. There is no higher logic or financial theory that separates their approach from the factor models developed internally by many active mutual funds. True passive investing requires a market capitalization weighting, and does not tilt towards factors that explain future stock returns. This implies an amusing paradox; if you are believer in DFA products then you are actually a believer in active management and surprisingly not purchasing a passive investing product as you might expect.

We have shown that a lot of the early work in academia was either omitted or ignored through some form of revisionist history but the inconsistency in the active/passive debate does not end there. The research shows that there have been points in time throughout history where investment practitioners have misinterpreted the findings of academia. Much of the confusion and controversy surrounding the active/passive debate can be traced back to William Sharpe, a Nobel Prize winner and the father of the Capital Asset Pricing Model (CAPM). In the CAPM, Sharpe makes the classic argument that the ‘market portfolio’ is the most efficient way to invest – there is no need to use MPT and go through the difficult exercise of calculating optimal portfolios and making poor assumptions. The market portfolio is already by design the ultimate passive portfolio. All ‘efficient’ investor portfolios can be constructed using a combination of the ‘market’ and T-bills based upon their return objectives and risk tolerance.

Unfortunately, the ‘market portfolio’ was erroneously misconstrued by investment professionals to mean the stock market. In reality, the market portfolio referred to a market capitalization-weighted portfolio that held all investable assets (such as stocks, bonds, commodities etc.). Such a portfolio does not even exist and is not readily investable. This confusion led to spectacular success for equity index funds, and helped to foster the cult of equities that has dominated investor portfolios ever since. The media now reports the “market” returns on a daily basis and constantly highlights performance over different time windows as if this was the benchmark that investors should use for their portfolios. The market as reported by the media is simply an index of large capitalization companies, instead it should be a broadly diversified and efficient asset allocation portfolio.

Sharpe also presented a now legendary argument that active management is a zero sum game, and net of the higher associated costs the average active manager will underperform the passive investor. However, his examples often referred to the universe of active equity mutual fund managers (or ‘stock-pickers’). He made the correct argument that in a market with hundreds of equity mutual funds, the stock market index would reflect the aggregate dollar weighting of their respective portfolios. If they charge a fee that exceeds the cost of investing in an index fund (such as an ETF), then they can be expected to underperform as a group.

Despite this, many active managers believe that they will outperform on the justification that they are willing to make bets and trade actively. Equity mutual fund managers boast about conducting extensive investment research and interviewing management at the companies that they choose to investigate. Their whole sales pitch typically sounds very businesslike and responsible. They view passive investing as a silly exercise for those that are lazy and incompetent but this is most definitely a fallacy and ignores the fact that investment managers are engaging in a competitive game. Deciding to be an active investor and putting in the effort does not grant excess returns any more than deciding to play baseball a few times a week will allow someone to compete in the major leagues. We agree with Sharpe that active management, especially at the individual stock level, is a difficult proposition. The fees for equity mutual funds cannot be justified in most cases and on average you are better off with passive ETFs or index funds.

So while we agree that Sharpe’s game theory logic is sound, there are limits to his arguments. Furthermore, there are other implications that both active and passive investors seem to overlook. As an example, his argument does not rule out the possibility or reality of some funds consistently outperforming the market index. It is just mathematically impossible for ALL of them to outperform the index because they ARE the index. Similarly, no group of people engaging in any activity can be above average relative to themselves!

It is easier to understand this by presenting another related example – poker. In the game of poker, 90% of all players lose because there is a commission charged to play, and as a result, on average the decision to play poker is a losing proposition. However, there are plenty of professional poker players that win consistently. It is just impossible for poker players to win as a collective since they are competing against each other while paying a fee to do so. On average it doesn’t make sense to play from an economic standpoint, but that also depends on whether or not you have an ‘edge’ over your competition – and just how large that edge happens to be. Hence, it is important to place Sharpe’s comments in the proper context and not as a condemnation of active management itself. Sharpe’s argument does not in any way rule out the possibility that quantitative rules can lead to a consistent edge, or that certain managers can outperform over time. Most importantly, it does not imply that markets (or stock returns) are unpredictable.

The potential to outperform the market is largely driven by two factors: 1) the number of skilled competitors relative to the number of investment opportunities; and 2) the relative skill/competitive advantage one has versus the competition. If there are 2000 mutual fund managers that are smart and only 5 stocks, then the chance of being able to find good opportunities is small – the market is efficient. If there are 5 mutual fund managers and 2000 stocks, then the chance of being able to find opportunities is high – market is inefficient. Furthermore, in terms of relative skill/advantage, if you have a team of 150 analysts and access to computers while your competitors work alone with hand calculators, clearly you are at a significant advantage.

The misconceptions from the CAPM helped to power a new camp of passive believers that took the extreme stance of shunning all forms of active management. In a fluid ecology like the financial markets this stance is too extreme. From a game theory perspective, if nearly all investors became passive then active investors would have tremendous opportunities to outperform. This is because the weights of different stocks would no longer efficiently reflect fair value. For example, let’s pretend that you are the only active mutual fund manager in the market and you had $10 million under management, suppose you notice that a publicly-traded company had $500 million in cash in the bank and no debt but was trading for a market cap of $50 million (and hence dramatically undervalued). Even if you invested all $10 million in the company it would not push the price anywhere near fair value. Other things being equal, the relative balance between passive and active investors tends to dictate pricing efficiency. At the end of 2012 passive index mutual funds based in the U.S. had around $1.3 trillion in asset, compared with around $13 trillion in the U.S. mutual fund market as a whole (Investment Company Institute). This means that 90% of mutual funds are actively managed so it is no surprise that such a high percentage of active managers underperform in terms of selecting individual stocks and bonds. Reviewing the recent SPIVA numbers, is often an amusing exercise in the ever popular large cap mutual fund category approximately 87% of managers failed to beat the S&P500 benchmark over the last 5 years. In other words, the market is highly efficient within asset classes.

But there is a flipside to this active/passive distortion within asset classes. What about looking at active management across asset classes? How many funds compete to dynamically allocate across asset classes using a global opportunity set? The answer is virtually none in the traditional asset management space. The only major group of investors that allocate across asset classes dynamically to manage risk are either macro or systematic hedge funds – a group that we shall see has enjoyed strong success. Why are there so few dynamic asset allocation funds? The answer is that the vast majority of pension funds, institutions, and financial advisors are instructed to follow a fixed policy mix that allows little room for variation. While the majority of within-asset class managers are active, the majority of across-asset (or asset allocation) managers are passive – this creates substantial opportunities.

Most financial advisors are passive with respect to their asset allocation and active with respect to using active managers to add value within either equities or bonds. This is exactly the opposite approach that one should take. A sound investment policy should utilize a dynamic asset allocation approach across asset classes and more passive approach within asset classes by using low-cost index funds. Paul Samuelson was a Nobel Prize winner and one of the fathers of the EMH. Samuelson emphasized that the markets are likely to be macro-inefficient, and as a result, favorable for active management across asset classes. In contrast, markets are highly micro-efficient – unfavorable for active management within asset classes. This bodes well for a dynamic asset allocation approach, but picking the best stocks is more likely to be a futile exercise. Jung and Shiller (2005) show that Samuelson’s assertions are backed up by the research – stock picking is hard, but a macro approach that looks at allocating across broad asset classes offers considerable opportunity.

As we have documented, passive investors often defer to academic research to justify a buy and hold approach. There were certainly some powerful ideas that emerged from academia that have stood the test of time, but the improper interpretation of those ideas into practice has resulted in its own dogma and set of beliefs. Nearly all modern financial planning for example is built upon the expectation of achieving a passive return by holding both stocks and bonds over long time horizons. For example, Siegel in “Stocks for the Long Run” finds that stocks have earned 6.5%-7% above the rate of inflation over the last 200 years. As a consequence, financial planners often use these long-term returns as fixed inputs in planning software. Clients are advised to ‘stay the course’ during turbulent market conditions so that they can collect this long-term return and achieve their financial goals. There is a prevailing belief that markets will always recover from difficult times within a particular investor’s time horizon. The very same financial economists that inspired a “buy and hold” approach (like William Sharpe) warn that this assumption is flawed. This traditional approach is both unrealistic, and impractical for most investors, and potentially very hazardous to their wealth.

The following quotes from William Sharpe, who as we stated was one of the fathers of passive investing, reveal the scope and magnitude of such misconceptions:

“I wrote a piece called “Financial Planning in Fantasyland” [in 1997] in which I railed about software models provided for people saving for retirement that assumed, as some pension actuaries still do, that stocks would provide the same return every single year. That’s crazy and anyone who tells you the exact amount you can earn investing in the stock market for the next 20 years or 30 years is either crazy or intentionally misleading you.”

The classic 4 percent rule, which is a favorite of financial planners, says to spend the same real dollar amount every year even though the portfolio may be going up and down like crazy; then just hope you’ll die before you run out of money. Perhaps they think that if the market has gone down, it will feel sorry for you and be more likely to go up in the future. The “V” we had in the recent crash probably made the situation worse; it encouraged people to say, “Don’t worry about it going down; it will come back up within a year or two.” It might, but financial economics says that you shouldn’t count on it.”

William SharpeThis is a substantial disconnect from the way that the typical passive investor or advisor is likely to think about investing. To be fair, Sharpe’s comments may even surprise most active investors but the truth is that both active and passive investors are misguided, and much of the reason stems from a failure to properly understand or make correct conclusions from the body of investment research. This misunderstanding extends equally to both academics and practitioners.

The final critical flaw and perhaps the most critical is a failure to understand investor behavior. A team of personal trainers, scientists and nutritionists can design the most sophisticated diet and exercise plan but it will have no chance of success if it is impractical for most people to follow. Herein lies the paradox of the active versus passive debate; finding the optimal mathematical strategy is futile unless it factors in typical investor behavior. At the end of the day whether a portfolio is active or passive is therefore irrelevant. A strategy will only deliver results to investors to the extent that they have the appropriate emotional makeup to handle its risk profile across a full market cycle (both bull and bear markets). The optimal strategy is the one that maximizes an investor’s realized wealth. In other words, the actual return they earn on their investments after making decisions to override their own portfolio allocations or switch investment managers. You can start out with Nobel-Prize winning advice and end up far worse than if you had taken a different approach as a direct result of your own actions. Below is a chart of typical investor behavior.

Investors tend to buy near the top because they don’t act until it seems as if everyone is participating in the market. They are often encouraged to hold on through corrections, and when the bear market eventually arrives they tend to hold through the early portion and then exit near the bottom when the masses are experiencing extreme panic and fear. This highlights the flaw in passive investing: it’s easy to buy and hold during a bull market since you are making money and so is everyone else, but the bear market is where things go downhill (to excuse the obvious pun) for all investors. Major losses tend to spur investors into action, and they often switch to a more conservative fund or hold large positions in cash at the wrong time. This highlights an important conclusion: investment managers may be either passive or active, but most investors are active! So how does this active investor perform in the real world? The chart is almost too painful to look at and can only be explained by making poor asset allocation decisions at the wrong time:

Long-Term Annualized Returns S&P 500 vs. Average Equity Fund InvestorSource: DalbarThe Dalbar report states that “at no point in time have average investors stayed invested long enough to derive the benefits of the investment markets. The emotions of investors often match the gyrations of the market, resulting in fear-based investing.” This leads them to significant underperformance versus a passive investment in the index (which clearly is a phantom bogey since few investors can sit on their hands). So if investors are prone to making poor decisions, do we have evidence that any particular type of approach tends to work best on average? One of the clues is to look at retention rates, or the number of years that investors hold on to a fund.

Average Mutual Fund Retention Rates

(Based on 20-Year Analysis)Source: DalbarIt turns out that asset allocation funds have the greatest success at keeping investors. Investors in equity funds are likely to switch to fixed income after bear markets, conversely fixed income investors are likely to switch to equity funds after witnessing a few years of a bull market. The typical asset allocation investor has a more balanced portfolio with equity and fixed income exposure. The added diversification lowers risk while providing some upside to bull markets with better downside protection than equity funds. This makes it less likely that the average investor will regret their decision and choose to switch.

A more tactical approach that can capture more of the upside in bull markets and less of the downside in bear markets is even easier to handle emotionally than an asset allocation fund. Bear markets are likely to trigger poor decisions because they are associated with much higher volatility, and consequently greater costs for changing asset allocation. Investor emotions run highest during bear markets when they fear losing all of their money. By employing a dynamic approach to reduce exposure to volatility and market downturns, it is less likely that investors will feel emotional pressure. In contrast, bull markets make all equity-centric managers look good, while conservative managers look really bad. Making 8% while the index is up 30% creates the fear of missing out on returns and creates the social discomfort of underperforming your peers. This can trigger poor decision making by switching to a more aggressive strategy from being more conservative at the wrong time. A tactical strategy that is typically more equity centric but seeks to hedge on the downside tends to capture greater returns in bull markets than a more passive and balanced asset allocation.

In general, dynamic asset allocation strategies that have the tools to capture reasonable upside in bull markets and reduce exposure to bear markets may have even greater success than asset allocation funds at retaining investors over the long-term. Dynamic asset allocation portfolios should be responsive to market conditions and therefore able to combat the very source of poor active investor decisions. A passive approach is sensitive to investor regret in either portion of the market cycle, but typically the regret is strongest in equity market downturns. Bear markets are the most dangerous for passive strategies (or active strategies within asset classes like equity mutual funds), especially major down markets like 2008, which caused a lot of investors to change their asset allocation to get more conservative. This active decision violates the entire principle of being passive (or active within asset classes) in the first place but it supports our point that the argument for active/passive investing is less relevant when taking into account average investor behavior. In other words, if you do not dynamically manage the asset allocation to address volatility or bear markets, investors are likely to do it for you anyway – and probably at the wrong time.

At Blue Sky, we take an open mind and strive to find the common middle ground where the truth often lies. We believe that the appropriate solution is neither traditional active or passive investing, instead we believe in Dynamic Asset Allocation which incorporates both portfolio theory and modern academic research. This approach is meant to be the most practical for investors that operate in a dynamic environment where:

- market risks and returns for different assets are time-varying

- investors have changing financial objectives and risk tolerance over time

- their own available capital to invest can fluctuate; and

- they are not rational and instead tend to have pronounced behavioral biases. (Thaler, 1992)

Our approach to investing employs many of the principles created and endorsed by the Nobel Prize winning thought leaders behind passive investing. We also utilize many of the risk management methods employed by some of the most successful active investors that have actually proven the value of their ideas over long periods of time. This is why we believe firmly that a dynamic asset allocation approach is optimal for investors in the real world.

A Call to Action

As we have demonstrated, bear markets are devastating because they tend to hurt investor’s realized returns – the actual return that they earn on their investments. Imagine watching your entire net worth shrink by 50% like in 2008 when you have retired and have no chance to earn money through a job anymore. Perhaps you are less than a decade away from planning to retire, and are now faced with the prospect of having to postpone indefinitely. If William Sharpe is telling us that we can’t expect the market to recover from such declines in the future, that is a scary proposition. As an advisor, what can you truthfully tell clients that are experiencing a large drawdown if that is the case? Telling them not to worry, and that things will bounce back is a statement without support from the fathers of traditional portfolio theory. Samuelson also agrees with this proposition and blasts notions of ‘time-diversification,’ which means we can’t expect the market to bail us out by just waiting 5 or 10 or even 20 years longer. If you are a passive investor holding and S&P500 ETF or an active investor holding your favorite equity mutual fund, are you going to be comfortable marching off a cliff with no consolation that your money will return? If we cannot count on faith that things will work out, we need an approach that will try to navigate the stormy seas of global markets.

The performance of traditional portfolios is highly dependent on the regime of the stock market. We consider a portfolio comprised of 60% in stocks and 40% in bonds as a typical investor portfolio, a common convention in the industry. The chart below shows the performance of a traditional investor portfolio (60/40) in both market states:

Performance of a “60/40” Portfolio in Different Market Regimes

(January 1971 – January 2015)Data Source: MorningStarThe difference in performance is striking. There is over an 18% spread in performance between up and down markets. This is why the concept of expected “average” returns can get you into trouble. In this case, passive diversification across both stocks and bonds cannot prevent losses in down markets. Only a tactical or dynamic asset allocation approach has the capability of making money in down markets. Ignoring market cycles is fatal when comparing different investment managers. Often investors or advisors will look to compare a passive strategic allocation approach to another type of investment approach over a 3 or 5 year time period during same bull market. This is a flawed analysis since a strategic approach often looks quite reasonable during up markets like it did in the 1990’s. The more aggressive the allocation to stocks, the better the relative performance, but this performance doesn’t extrapolate to bear markets where more aggressive portfolios could get decimated. Investors should embrace strategies such as dynamic asset allocation which are designed to maximize returns and reduce risk across a full market cycle versus shining in one market environment.

An Uncertain Future

While we do not know whether we are in a down market until after the fact, long-term expectations generated using valuations have been proven to be a useful guide in academic research. The bad news is that the weather forecasts simply don’t look good. As a consequence of yield curve math, we know that long-term bond returns are nearly 100% forecastable. If one receive a 2% yield on a bond that matures 10 years from now and they hold until maturity, unless it defaults they are guaranteed to achieve a 2% nominal return. Bonds therefore offer poor long-term prospects. The outlook for equities is not much rosier – there is near uniform agreement in academic circles (see: Barberis, Shiller) that very long run equity returns can be estimated with reasonably high accuracy. Valuations and other factors are well above average according to AQR. Given that we are now beginning the sixth year of a bull market that began in 2009, the probability that the next few years will experience a bear market in equities is reasonably high. This increases the risk of severe short-term damage to traditional investor portfolios since bond returns this time around are less likely to provide a strong enough cushion. The following are the expected (forecasted) returns to a 60/40 portfolio (often a typical investor portfolio) over the next 10 years courtesy of AQR:

Clearly the risks to holding a 60/40 portfolio are perhaps the highest they have ever been!

Nobel Prize-winning economist Robert Shiller has recently conveyed a sober message to investors: Start saving more money than you have in the past because returns for both stocks and bonds are going be lower than what you are used to experiencing. Shiller was one of the few people that warned of the tech bubble in the late nineties, and subsequently the real estate bubble in the recent decade. In his third edition of “Irrational Exuberance,” he says that stock valuations look expensive. Using Shiller’s favorite valuation measure, the cyclically-adjusted price-earnings ratio (which compares current prices to the prior 10 years’ worth of earnings) is “higher than ever before except for the times around 1929, 2000, and 2008, all major market peaks,” he writes in his new preface to the third edition. His outlook for bonds is even less optimistic. Given that interest rates are extremely low relative to historical norms, Shiller writes: “The U.S. bond market, showing such low yields, looks as if it may have gone through something of a bubble, and may collapse further, eventually.” However, Shiller does note that emerging markets and foreign equities look attractive.

We believe that investors need a better approach to dealing with the road ahead. Certainly the current outlook does not look promising. Forecasts of long-term returns are only a guide to the future. But that doesn’t help to guide a portfolio for investors through the market cycles that will occur in between. A Dynamic Asset Allocation approach is capable of adapting to changes in global markets over time. This makes it a more logical solution than holding a strategic portfolio and hoping that the last five years of positive returns will extrapolate into the future.

Conclusion

The standard approach in the investment industry is to produce a policy or strategic allocation for investors. This was built upon portfolio theory developed over 50 years ago that is out of touch with modern research. This methodology fails to address the realities of financial planning and investor behavior. More importantly it does not provide an adequate framework for investment management. Curiously, many of the same fathers of traditional portfolio theory – including Nobel Prize winners Paul Samuelson, Robert Shiller, Eugene Fama, and Robert Merton – support the fact that broad asset class performance is predictable. This mathematically implies that a dynamic asset allocation approach is superior to a strategic allocation.

We define Dynamic Asset Allocation from a financial planning perspective as adjusting investor portfolios to consider all aspects of their unique situation and updating as their situation changes over time. From an investment perspective we define Dynamic Asset Allocation as a system or method to address change in global financial markets. This dictates taking a macro approach and dynamically weighting portfolios across a global opportunity set of different asset classes. As markets shift, our expectations should change and mathematically so should our portfolios. A Dynamic Asset Allocation approach is more practical than traditional active management because it is directly adapting to the primary factors than explain stock returns. Research shows that broad asset classes explain between 65-90% of performance for investor portfolios. Furthermore, research also shows that the market is efficient at the stock selection level but inefficient at the macro asset class level. In contrast, traditional active funds that employ stock selection are focusing on the remaining 10-35% of portfolio performance where it is difficult to add value. We believe that focusing on active asset allocation using passive index funds is the best approach. Unfortunately this is the opposite of what most advisors or investment managers do in the industry.

The debate between active and passive management has confused both investors and advisors (and even academics). We instead have reviewed the research in the quest to find the middle ground. Our conclusion is that neither approach is ideal for investors since they do not account for investor behavior. The optimal approach is to maximize realized investor returns or the dollar-weighted returns investors earn after making decisions to switch in and out of different investments. Research shows that investors have poor realized returns and we believe that this stems from a failure of both styles of investing to address market cycle risk. Bull and Bear markets causes investors to become emotional and regret their investment decisions. Investors regret being conservative in bull markets and being aggressive in bear markets. A Dynamic Asset Allocation directly manages exposure to market cycles and seeks to remove the source of poor investor decision-making.

Given expectations for lower than average long-term returns across asset classes, a policy allocation approach may yield insufficient returns coupled with substantial risk for investor portfolios. The future as always is still uncertain, and investors need a roadmap for how to get from the present to reaching their financial goals. The better solution is a “Dynamic Asset Allocation” approach that takes advantage of global opportunities across asset classes while managing risk at the portfolio level. The principles underlying dynamic asset allocation are timeless and enduring.

References

- “An Intertemporal Capital Asset Pricing Model”, 1973, Robert C. Merton, Econometrica

- “The Quants”, 2010, Scott Patterson, Crown Publishing

- “Active Share and Mutual Fund Performance”, 2013, Antti Petajisto,SSRN

- “The Truth about Asset Allocation”, May 2004, John Nuttall, FORUM magazine

- “The Equal Importance of Asset Allocation and Active Management” 2010, Roger Ibbotson, James X. Xiong, CFA, Thomas M. Idzorek, CFA, and Peng Chen, CFA,

- “Dynamic Asset Allocation”, 2010, James Picerno, Bloomberg Press

- “Portfolio Theory and Capital Markets”, 2000, William Sharpe

- “Investing for the Long Run when Returns are Predictable”, 2000, Nicholas Barberis, Journal of Finance

- “Dividend Yields and Stock Returns”, 1987, Eugene Fama and Kenneth French, Journal of Financial Economics

- “The Theory of Speculation”, 1900, Louis Bachelier -translated in 2006 Princeton University Press

- “Samuelson’s Dictum and the Stock Market”, 2005, Jee Jung and Robert Shiller, Economic Inquiry

- “Portfolio Selection”, 1952, Markowitz, Journal of Finance

- “Lifetime Portfolio Selection by Dynamic Stochastic Programming”, 1969, Paul Samuelson, Review of Economics and Statistics

- “Multifactor Explanations of Asset Pricing Anomalies”, 1996, Eugene Fama and Kenneth French, Journal of Finance

- Kenneth French Data Library: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

- “Style Rotation and Momentum and Multifactor Analysis”, 2003, Kevin Wang, Working Paper

- “Tactical Alpha: The Case for Active Asset Allocation”, 2013, Adam Butler, GestaltU

- “Time Series Momentum”, 2012, Tobias Moskowitz, Yao Ooi, Lasse Pedersen,Journal of Financial Economics

- “Irrational Exuberance” 3rd Edition, 2015, Robert Shiller, http://irrationalexuberance.com/main.html?src=%2F

- “Stocks for the Long Run”, 5th Edition, 2014, Jeremy Siegel

- DALBAR 2014: “Quantitative Analysis of Investor Behavior Advisor Edition”

- “How to Invest in a Turbulent Market”, 2013, William Sharpe, Stanford Business School

- “Asset Allocation vs. Security Selection; Their Relative Importance”, Renato Staub and Brian Singer, CFA Institute 2011

- “The Case for Dynamic Asset Allocation”, 2012, BNY Mellon Asset Management/Mellon Capital

- “A Non-Random Walk Down Wall Street”, 1999, Lo and MacKinlay, Princeton University Press

- “The Winner’s Curse: Paradoxes and Anomalies of Economic Life”, 1992, Thaler, Princeton University Press

Endnotes

- “Up Market” defined as S&P500 Total Return price greater than the price 12 months prior. “Down Market” defined as S&P500 Total Return price less than price 12 months prior. Return stated is the annualized return computed on a continuous series of monthly returns concatenated by active regime.

Important Information

This paper is copyrighted by Blue Sky Asset Management, LLC (“BSAM”) with all rights reserved. Any reprinted material is done with permission of the owner. This material has been prepared for informational purposes only and is not an offer to buy or sell any security, product or other financial instrument. Past performance is not necessarily a guide to future performance. All investments and strategies have risk, including loss of principal.

BSAM and its affiliates do not render advice on tax and tax accounting matters to clients. This material was not intended or written to be used, and cannot be used or relied upon by any recipient, for any purpose, including the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws.The author(s) principally responsible for the preparation of this material are expressing their own opinions and viewpoints, which are subject to change without notice and may differ from the view or opinions of others at BSAM or its affiliates. Any conclusions presented are speculative and are not intended to predict the future of any specific investment strategy. This material is based on publicly available data as of the publication date and largely dependent on third party research and information which we do not independently verify. We make no representation or warranty with respect to the accuracy or completeness of this material. One cannot use any graphs or charts, by themselves, to make an informed investment decision. Estimates of future performance are based on assumptions that may not be realized and actual events may differ from events assumed. BSAM is not acting as a fiduciary in presenting this material. Benchmark indices are presented for illustrative purposes only and do not account for deduction of fees and expenses incurred by investors.

The strategies discussed in this material may not be suitable for all investors. We urge you to talk with your investment adviser prior to making any investment decisions.